multistate tax commission member states

Sellers May Be Required to Collect Sales Tax In States Where They Have No Physical Presence. It is the Multistate Tax Commission MTC or.

Multistate Tax Commission Home

Lucy and yukino time travel fanfiction.

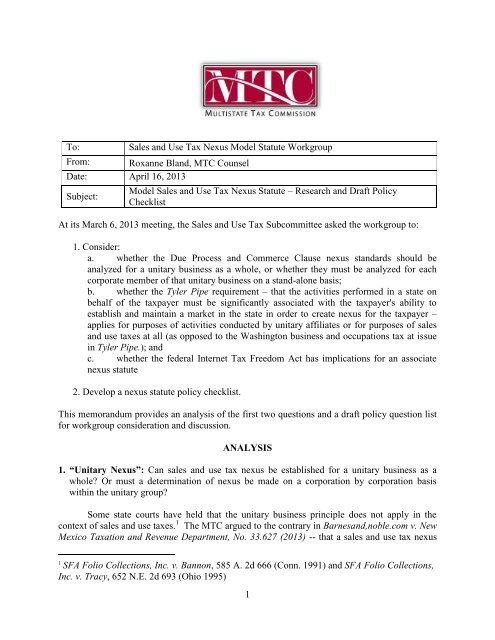

. The Multistate Tax Compact 3 provides that the MTC may conduct audits of. Multistate Tax Commission Member States accessed February 17 2021. The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co.

This text is quoted verbatim. These states join in. Its purpose is to create uniformity amongst.

The Multistate Tax Commission a multistate agency made up of state taxing authorities whose aim is to encourage uniform state tax laws has adopted after several. This case considers whether in-state activities. 2 as of 2021 the district of columbia and all 50 states except for nevada are members in some capacity.

Law360 April 25 2022 402 PM EDT -- Vermont will join the Multistate Tax Commission as a sovereignty member beginning July 1 after being approved to join by the executive committee. The Multistate Tax Commission is an intergovernmental state tax agency working on behalf of states and taxpayers to facilitate the equitable and efficient administration of state tax laws. The Multistate Tax Commission is a United States intergovernmental state tax agency created by the Multistate Tax Compact in 1967.

One of the most influential sources of policymaking in the state tax law arena is not a state legislature court or executive agency. Sovereignty members are states that support the purposes of the Multistate Tax Compact through regular participation in and financial support for the general activities of the. The Multistate Tax Commission is an intergovernmental tax cooperative agency that was born from the multistate tax compact law.

And what help is available through the Streamlined Sales Tax Governing Board and its. Multistate Tax Commission About us accessed October 19 2011. The commission has developed a Uniform Sales and Use Tax Exemption Certificate used by most states.

It was established in 1967 as part of the Multistate Tax. The Multistate Tax Commission MTC adopted its long-awaited guidance interpreting Public Law PL 86-272 protections for internet businesses on August 4 2021. Prior to your appointment collect all of your tax documentation and place it in an envelope with your name and a cell phone number where you can be reached written clearly on the outside.

Gas stations with free air. This multijurisdiction form has been updated as of June 21 2022. Files a properly executed exemption certificate from all of our customers who claim sales tax exemption.

S are states that support the purposes of the Multistate Tax Compact through regular participation in and financial support for the general activities of the Commission. As of 2011 47 states are members of the. The Multistate Tax Commission is an intergovernmental state tax agency located at 444 North Capitol Street NW in Washington DC.

The Commission has developed a Uniform Sales Use Tax Resale Certificate that 36 States. If we do not have this certificate we are obligated to collect the tax for the state in. Multistate Tax Commission Member States.

The Multistate Tax Commission is an intergovernmental state tax agency located at 444 North Capitol Street NW in Washington DC. It was established in 1967 as part of the Multistate Tax.

Multistate Tax Commission Home

Multistate Tax Commission Home

Towards A Multistate Territories Tax Commission For Australia Economics Law Research Institute

The Significance Of The Multistate Tax Compact And Uditpa Amid Recent Developments Accountingweb

Multistate Tax Commission News

Recent California State And Local Tax Developments The Cpa Journal

Why States Should Adopt The Mtc Model For Federal Partnership Audits

Multistate Tax Commission Home

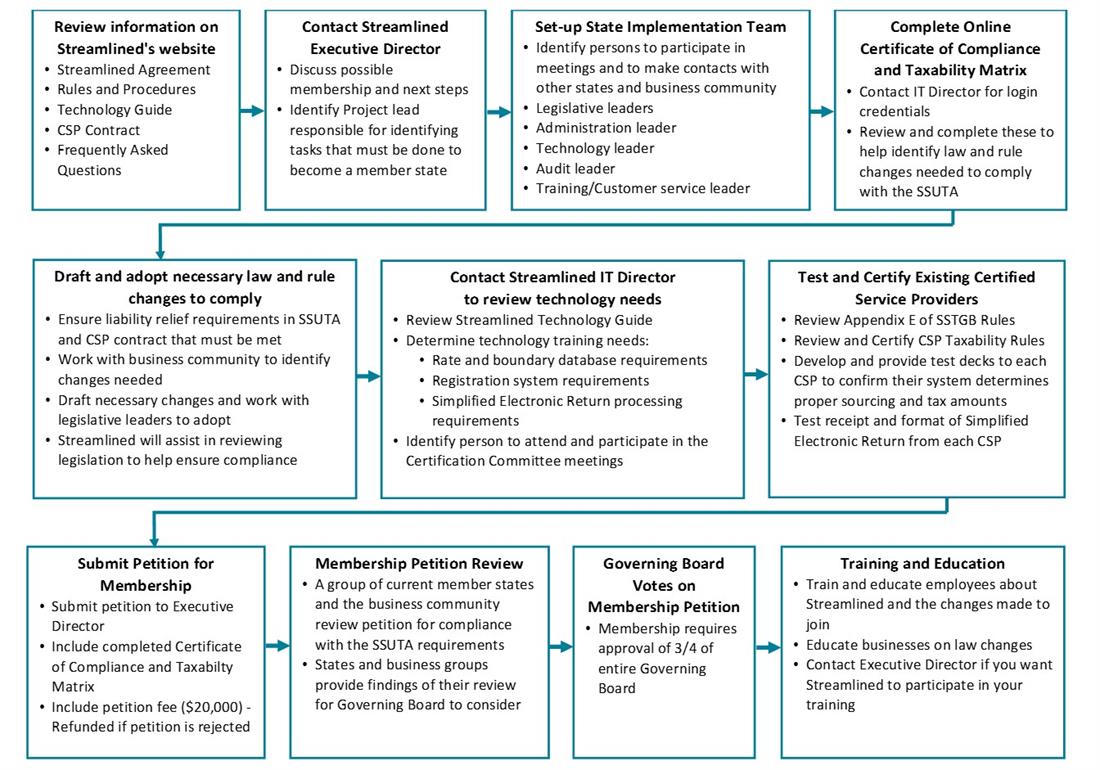

State Membership Process Chart

Materials Multistate Tax Commission

2021 Multistate Tax Developments Dbriefs Webcast Deloitte Us

Mtc Adopts New Internet Rule Regarding Pl 86 272 Redw

Multistate Tax Commission Home

Multistate Tax Commission Home

Interpretation Update To Law Protecting Businesses From Nexus Dhjj

Let S Talk About State Taxes And Nexus Htj Tax

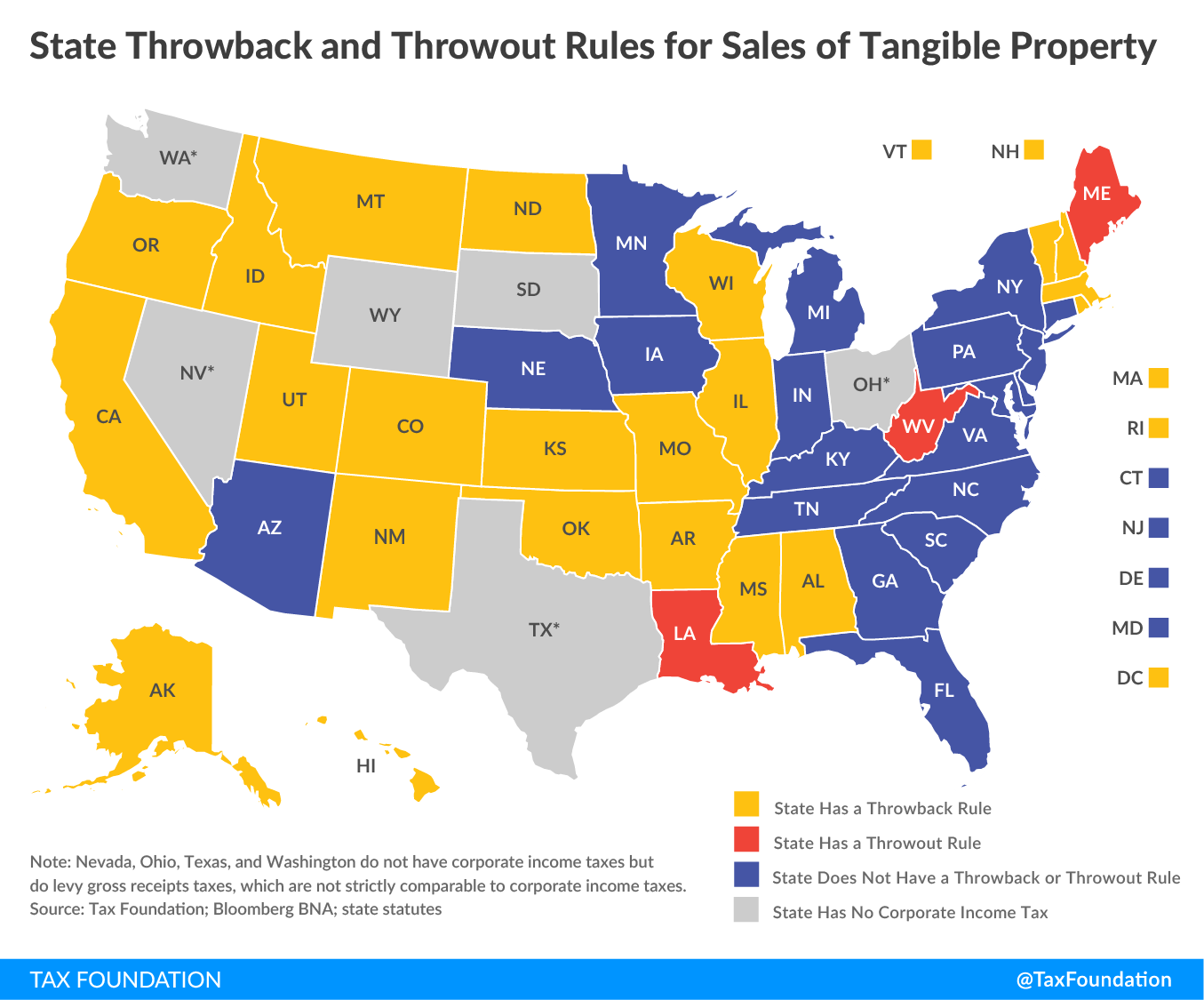

State Throwback Rules And Throwout Rules A Primer Tax Foundation

Why States Need To Enact Mtc Model Statute In 2020 Journal Of Accountancy